In just over a decade, the first cryptocurrency has spiked, followed by the emergence of the augmented reality experience of the metaverse and the massive adoption of DeFi, one of the essential innovations of blockchain technology. DeFi revolutionizes the global economy and redefines traditional financial services by disrupting the role of intermediaries. While the traditional financial system works on a centralized platform, controlled by government agencies and other intermediaries, DeFi operates according to a protocol that runs on a decentralized network powered by blockchain.

Experts believe the massive adoption of DeFi will be exponential thanks to DeFi financial products like efficient stablecoin trading, DeFi lending or Yield Farming, DEX (Decentralized exchanges), and DeFi insurance.

CELO is among projects harnessing the benefits of DeFi by supporting the creation of DApps and smart contracts in aiming to build a world where financial systems are open and borderless. The platform aims to make financial tools accessible for anyone worldwide with a mobile phone so that the world’s 6 billion smartphone users may safely buy and sell items send and borrow money to anybody in the world.

CELO is a decentralized form of digital asset/cryptocurrency and the core utility, reserve, staking, and governance asset for the Celo platform. Celo features Celo Dollars (cUSD) and cEUR, stablecoins pegged to the value of dollars and euros native to the Celo platform.

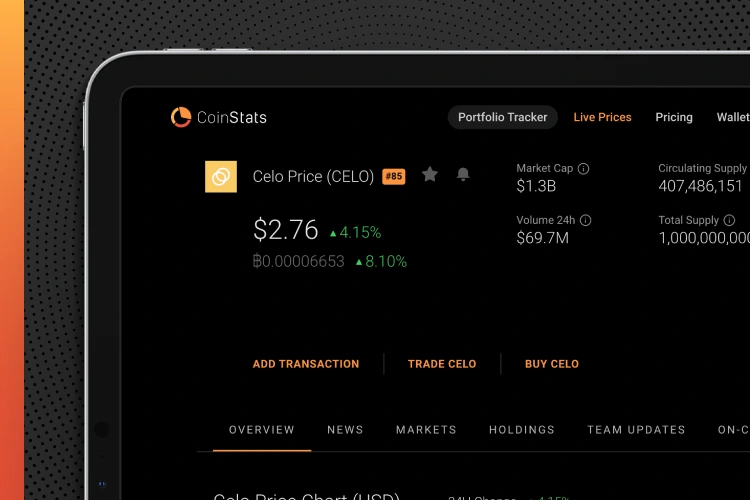

Check the CELO current price, market cap, circulating supply, trading volume, historical statistics, etc., on CoinStats, one of the best crypto platforms around.

Read on to learn everything you need to know about the Celo blockchain, the Celo community, and learn how to make a Celo purchase in a few simple steps.

Let’s jump right in!

What Is CELO

Around 1,7 billion people across the globe don’t have access to financial services, making it harder to reach prosperity. The Celo project was created to address this issue and solve the problem of financial exclusion.

Celo is a blockchain ecosystem that makes financial tools accessible to everyone, enabling them to send funds to their contacts with a mobile phone. It’s a payments infrastructure platform that uses phone numbers as public keys to let phone owners create DApps and smart contracts as part of decentralized finance (DeFi) products.

Celo features Celo Dollars (cUSD) and cEUR, stablecoins pegged to the value of dollars and euros native to the Celo platform. The Celo token (CELO) is the protocol’s native asset, serving as a utility token that enables users to participate in network consensus through its Proof-of-Stake system and pay for on-chain transactions. CELO also has governance applications, allowing the token owners to vote on governance decisions.

How Does CELO Work

The CELO network relies on the support of three contributors:

- “Light clients” – CELO Network apps operating on mobile devices, like Celo’s mobile wallet.

- Validator Nodes – Computers that participate in Celo’s consensus mechanism, validate transactions, and create new blocks.

- Full Nodes — Computers operating as the bridge between Validator nodes and mobile wallets, receiving requests from “light clients” and transmitting transactions to “Validator nodes.”

The Byzantine Fault Tolerance

An essential feature of Celo is a Proof of Stake governance mechanism known as the Byzantine Fault Tolerance (BFT).

Validator nodes must stake a minimum of 10,000 CELO tokens to power the blockchain and vote on modifications. This means that everyone who owns CELO can assist in administering the network. Each validator node receives a share of the block reward for verifying transactions. There are only 100 of them at any given moment, determined by a vote of the full nodes. The fees paid out by light clients are used to fund the rewards of full nodes.

cUSD

Securing cryptocurrency transactions with the accountability and effectiveness of stablecoins, such as the cUSD, is at the heart of CELO’s business model.

CELO uses a so-called “programmatic reserve,” an overcollateralized reserve of CELO and other cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), to ensure that the value of each cUSD is always equal to one US dollar. This means that CELO may be exchanged for cUSD and vice versa.

CELO holders will be able to propose and vote on establishing stablecoins that match the value of other fiat currencies, such as the Pound or Chinese Yuan, in the future.

The native CELO Gold (CELO) coin is a trustworthy token accessible on several crypto exchanges. CELO Gold has an ERC-20 interface so that users can interact with CELO via the token standard, but it’s important to note that not all CELO transfers are required to go through the token contract. The price of cUSD is balanced with the price of CELO to keep this stable coin at $1. The balance means the price of CELO will climb up with an increase in the number of Celo users and transactions. CELO is a governance token and a validation token that can be used in future staking endeavors.

CELO’s Story in a Nutshell

Rene Reinsberg, Sep Kamvar, and Marek Olszewski are co-founders of Celo. They launched the network back in 2017. Celo is also backed by a team of brilliant minds with a prior experience in Visa, MIT, Google, GoDaddy, Harvard University, Bank of America, Twitter, Cambridge University, to name a few.

Some of the prominent investors of the Celo platform are venture capitalists such as Social Capital, General Catalyst, etc.

Celo is an open platform that makes financial tools accessible to anyone with a mobile phone. It is decentralized, programmable, and customizable. Celo facilitates transactions, letting users send cryptocurrencies to a phone number without the need to copy and paste long, randomly generated addresses. To make this happen, Celo designers have created a distributed address-based encryption protocol that allows sending and receiving value directly with a phone number. Your phone number is linked to a wallet address that accepts cUSD and CELO; then, a phone number code is recorded on the blockchain network servers, which guarantees that any amounts paid to your mobile number are only forwarded to you not to third parties. CELO uses various cryptographic algorithms to verify your phone number to finalize account creation. With CELO, you can link multiple phones to one wallet address by paying a small fee for verification. “CELO is like WhatsApp for money,” said Polychain Capital’s CEO.

Celo is a user-friendly network, and users don’t have to know anything about blockchain. All the information they need is stored in their phone book, and their contacts become the addresses they can send to and receive funds from. All notifications from Celo are received through familiar text messages to avoid confusing users.

Since the launch of mainnet on Earth Day 2020, several significant crypto exchanges, including Coinbase and Binance, have been supporting the CELO token. As of writing, CELO is ranked among the top 100 most valuable cryptocurrencies, with a total market cap of over $2 billion and an average trading amount of around $100 million.

What to Look For When Purchasing CELO

If you’ve decided to invest in digital assets, it’s essential to understand all of the risks involved. Before your CELO purchase, you should consider the following factors:

- Celo uses a programmatic reserve to ensure that CELO USD is always equal to one US dollar. The price of cUSD is balanced with the price of CELO to keep this stable coin at $1. The CELO price will climb up with an increase in Celo users and transactions.

- CELO has a fixed supply and a variable value related to the total value of stablecoins in circulation throughout the Celo ecosystem. A total of 1 billion CELO tokens will be made available for purchase in the future, with 250 million now in circulation.

- CELO dynamically adjusts the supply of stablecoins in circulation to help keep their price as close to the target value as possible.

- Celo network’s security is provided by the PoS (proof-of-stake) governance mechanism that syncs the distributed computers. Blockchain validators are selected through a complicated election process as part of the network’s security.

Ways to Purchase CELO

The most active CELO trading exchanges are Coinbase, Binance, and OKEX. To start trading, you need to create an account, i.e., a Coinbase account. Follow our step-by-step guide below to get started:

Step #1: Choose an Exchange

CELO is available on many cryptocurrency exchanges. You’ll have to compare them to choose the one that supports CELO and has the features you want, such as low transaction fees, an easy-to-use platform, and 24-hour customer support. When you invest through some crypto brokers, you’ll pay nothing in commissions, which is a major benefit compared to others. Also, consider if the cryptocurrency exchange allows buying CELO with your preferred payment method, such as a credit or debit card, another cryptocurrency, or a bank transfer.

Step #2: Create an Online Account

After you’ve decided on a reliable exchange, the next step is to open a trading account to buy or sell CELO. The requirements differ depending on the platform you pick. Personal information such as your name, contact number, email address, home address, social security number, and a copy of your driver’s license, passport, or government-issued ID will be required in most transactions. You must provide this information to be authenticated and start trading.

Step #3: Fund Your Account

After verifying your account, you must deposit funds for buying CELO coins and other cryptocurrencies. You can use a credit or debit card, bank account, or crypto from a cryptocurrency wallet to buy REN. The payment method you use to buy REN coins will be determined by the platform, location, and preferences.

Step #4: Make Your Purchase

You must first place a Buy CELO order with the broker and wait for a response. You can place many types of orders, just as in stock trading. Below are the two most common orders:

Market orders: A market order tells your broker that you want to purchase CELO immediately at the current market rate. Market orders don’t provide you with much control over the price you spend per coin, and you may wind up paying a rate that differs from the one displayed on the exchange.

Limit orders: Limit orders indicate that you want to buy CELO at or below a specific price point. Your broker will ask you the number of coins you wish to acquire and the maximum price you’re ready to pay for each once you’ve placed an order. The coins will only appear in your wallet if your broker fulfills your order at or below your requested pricing. The broker may cancel your order at the end of the day if the price increases over your limit.

Step #5: Setup a Wallet (Optional)

Once you’ve completed your CELO purchase, the next step is to select a crypto wallet to store CELO securely. Your coins can be stored in your brokerage exchange wallet; however, in this case, they’ll be exposed to hacking. We highly recommend creating a private wallet with your own set of keys. Depending on your investing preferences, you might choose between software and hardware wallets, the latter being a more secure choice.

How to Sell CELO

You may cash out your CELO on the same exchange where you purchased in a few simple steps:

- Sign in to the exchange.

- Place a sell order on the market.

- Select the quantity of CELO you wish to sell from the drop-down menu.

- Complete your transaction by clicking “Submit.”

- Confirm the sale price and associated costs, and then complete the sale of CELO.

Where to Store Your CELO

Now, let’s look into various types of wallets where you can securely store CELO coins. You should pick a wallet based on how much CELO you have and what you want to do with it. We distinguish between Software Wallets (Hot Wallets) and Hardware Wallets (Cold Wallets).

Hardware wallets or cold wallets, like Trezor or Ledger, are the most reliable options, as they come with safe offline storage and backup features. These are more suitable for experienced users who own large amounts of CELO tokens. Software wallets are user-friendly and free to use. They store your keys online and are therefore less secure than hardware wallets, but their ease of use makes them ideal for newbies with a few tokens.

Hardware Wallet

Ledger (Ledger Nano X or S) is a leading company in the hardware wallet space and has been in business since 2014. They use an operating system called BOLOS to integrate a secure chip for their crypto hardware wallets. It handles security with a pin code and a backup 24-word recovery phrase. The Ledger hardware wallet is well-suited for CELO yield farming and authorizing transactions because Celo supports Ledger integration. Furthermore, it supports 1000+ coins and all ERC20 tokens.

Ledger has an application called Ledger Live that you can install on your computer and mobile phone for crypto staking and lending.

Software Wallet

Software wallets, also known as Hot wallets, are connected to the internet at all times. They store your keys online and are therefore less secure. Software wallets are free to use, and their ease of use makes them an ideal choice for newbies with a few tokens. One of the most popular and widely used software wallets are the Coinbase wallet and the CoinStats Wallet, available for free download on Google Play and App store.

Trade or Sell Your Cryptocurrency

If you intend to trade your cryptocurrencies regularly, you’ll need to keep your funds on an exchange. The risks associated with this are more significant than storing your assets in a hardware wallet; therefore, the exchange’s security should be your primary consideration. Some exchanges, such as Coinbase, store most users’ assets in cold storage, making it an exceptionally safe option.

You may also actively trade CELO like any other cryptocurrency. Active traders purchase and sell their currencies and tokens strategically whenever the price is most advantageous to their holding asset. Although active trading demands more of a time investment than long-term investing and selling, it may allow you to start gaining profits quicker than other investment strategies.

Consider the Use of Cryptocurrency in the Future

The cryptocurrency world is fascinating – ranging from the technology put in place by Bitcoin to new and intriguing initiatives like Celo. There is something exciting for everyone in the cryptocurrency world. Before investing in a cryptocurrency project, you may wish to research a few rival projects to diversify your portfolio.

Investment Advice Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any securities, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

Cryptocurrency is a highly volatile market, do your independent research and only invest what you can afford to lose. Performance is unpredictable, and the past performance of CELO is no guarantee of its future performance.

There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider your own circumstances and take the time to explore all your options before making any investment.