Total crypto market capitalization has shrunk by $216 billion since yesterday in a fall that has dropped it to just below $2.78 trillion according to CoinGecko.

The massive wipe-out is the second of its kind this month after leveraged derivatives traders were liquidated on Nov. 11 resulting in a $125 billion slump.

On-chain analyst Dylan LeClair has again fingered leveraged positions for today’s massive slump.

Leverage shakeout close to complete$BTC pic.twitter.com/rQyfaT8HUd

— Dylan LeClair

(@DylanLeClair_) November 16, 2021

The total market cap has now fallen back to early November levels as major crypto assets continue correcting from their recent all-time highs.

Bitcoin Leads the Drop

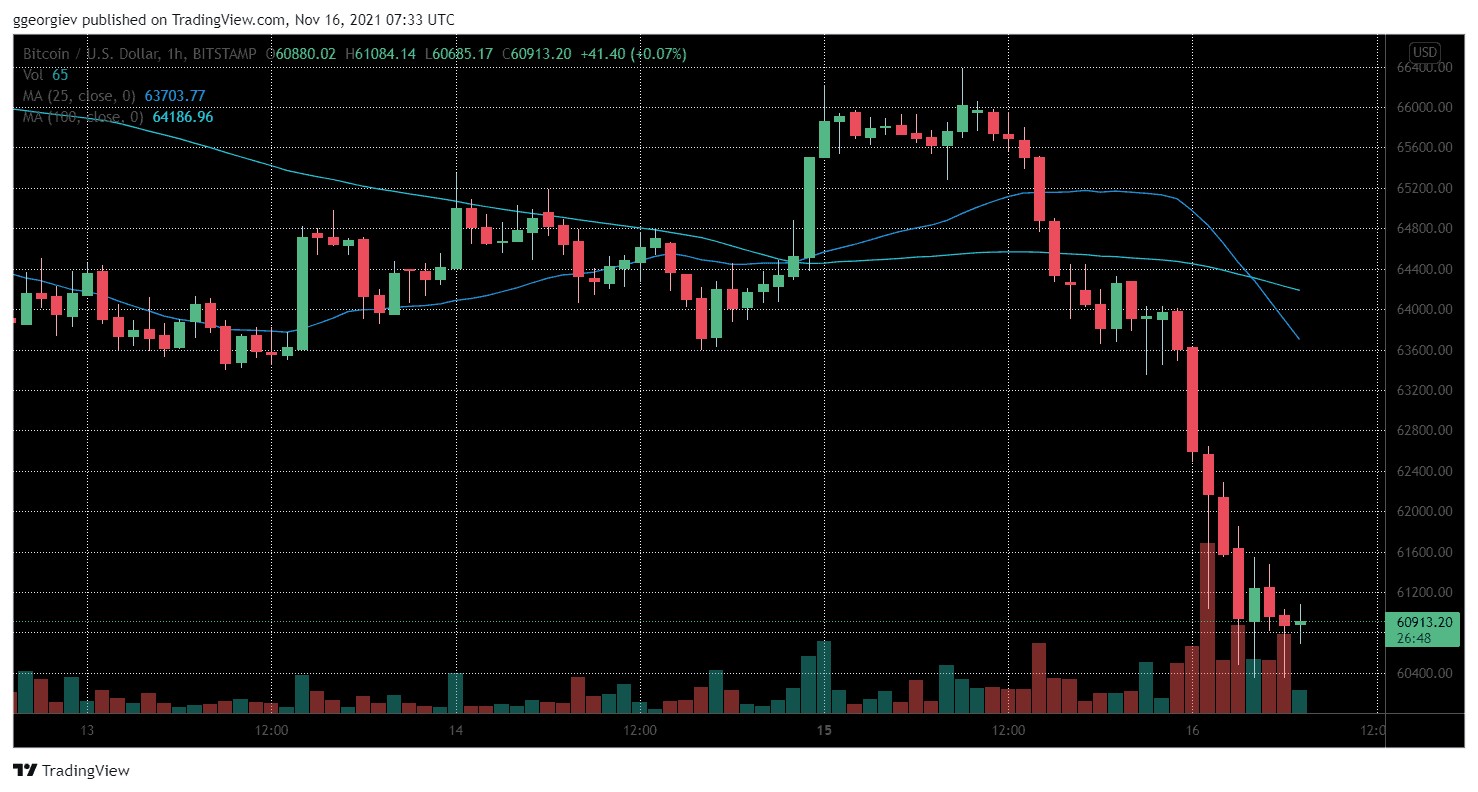

Bitcoin is leading markets into the red during the Tuesday morning Asian trading session. BTC has lost 7.3% over the past 24 hours in a fall to around $61K at the time of writing.

The king of crypto has retreated 11.6% from its Nov. 10 all-time high of a touch over $69K. Pricing models such as stock-to-flow are still predicting larger gains for Bitcoin before the end of this year with a target price of $135K painted.

Despite this latest loss, BTC has still more than doubled in price since the beginning of the year when it was trading at around $29K. According to Tradingview, there is support at the 50-day moving average which is around the $58,800 price zone.

Bitcoin’s fall comes just a day or so after its Taproot privacy upgrade went live with no issues.

Altcoins Bleeding in Crypto Plunge

As usual, the rest of the crypto market is being dragged down by big brother. Ethereum has retreated 8% on the day in a tumble to $4,329 at the time of writing. ETH has now lost 11.2% from its all-time high of $4,878 also on Nov. 10.

The altcoin market is a sea of red at the moment with no token in the top 50 making a gain today. Binance Coin, Solana, Cardano, XRP, and Polkadot have all lost between 6% and 11% over the past 24 hours.

Larger losses are being felt by other altcoins such as Litecoin (LTC), Chainlink (LINK), and Crypto.com (CRO) which have all decreased more than 12% on the day.